Pure Gold, Your Ultimate Investment

Introduction.

Ecclesiastes 11:2

Invest in seven ventures, yes, in eight;

you do not know what disaster may come upon the land.

The investment area is fraught with uncertainty and the road to wealth can be difficult to navigate. It would be wise for you to diversify your investments in several ventures. If one venture performs poorly then others can compensate.

Table of Contents

*** You Can Click Below To Jump To Section ***Introduction.

Where Should you Invest?

Why Gold?

Protect Yourself From Inflation With Gold.

.....You live on an island.

.....A lone sailboat swings by.

.....Loss of purchasing value.

.....The smart investor.

.....Why is this story relevant today?

.....What about Federal Reserve Bank changing the money supply?

.....What about Federal Reserve Bank changing the interest rate?

.....What does history tell us?

So what is the best way to buy gold?

Where is the best place to buy gold?

Introducing you to JM Bullion.

.....But What About The Quality?

.....But Why Are They Able To Offer A Lower Price Than Competitors?

What are the best gold coins to buy?

.....Gold Coin - American Eagle, 1 ounce

.....Gold Coin - Canadian Maple Leaf, 1 ounce

.....Gold Coin - South African Kruggerand, 1 ounce

.....Gold Coin - Austrian Philharmonic, 1 ounce

.....Gold Coin - British Britannia, 1 ounce

.....Gold Coin - American Buffalo, 1 ounce

What are the best silver coins to buy?

.....Silver Coin - American Eagle, 1 ounce

.....Silver Coin - Canadian Maple Leaf, 1 ounce

What are the best gold bars to buy?

.....Gold Bar - Pamp Suisse

.....Gold Bar - Credit Suisse

.....Gold Bar - Royal Canadian Mint

.....Gold Bar - Valcambi Suisse

What are the best silver bars to buy?

.....Silver Bar - Johnson Matthey

.....Silver Bar - Engelhard

.....Silver Bar - Royal Canadian Mint

.....Silver Bar - Heraeus

Introducing you to Golden State Mint.

.....They are not only a Precious Metal Dealer, they are also a Mint.

.....Their Prices Are Very Competitive.

.....American Eagle Gold Coin.

.....Canadian Maple Leaf Gold Coin.

.....Austrian Philharmonic Gold Coin.

.....South African Krugerrand Gold Coin.

.....American Silver Eagle Coin.

.....Canadian Silver Maple Leaf Coin.

Conclusion.

Where Should you Invest?

Should one of your investment ventures be Bitcoin? Well, it can go up a lot but it can also go to zero. After all it is just air, right? There is no real tangible asset behind Bitcoin. Sure, you can invest some into it if you want. Just don’t go all in. Who knows the future really?

Yes, stocks can be another investment venture of yours. And of course your real estate in another one. Your business, if you have one, in another.

But there is one venture you do not want to miss out on. We are talking about precious metals and most especially the yellow one which is the ultimate form of money - Gold. Yes, the one you can hold in your hand. In uncertain times, this type of asset holds up better any other investment, bar none. Gold investing can be one of your best moves. And we will tell you the best way to invest in gold.

*** Go Back To Table of Contents ***Why Gold?

Just look at the US dollar and other currencies. We all know the government is constantly printing and increasing the money supply. Since the 1930s, the U.S. dollar has lost 99% of its value against gold. Same with all other currencies. Why? Because they can’t print gold. As a result, the supply of gold does not change but the supply of paper money does. Printing more paper is a heck of lot easier than trying to dig out more gold from the ground, wouldn’t you agree? And adding more zeros to a financial computer screen is even more easy.

*** Go Back To Table of Contents ***Protect Yourself From Inflation With Gold.

Let me tell you a story and you'll get the idea why gold bullion is the real deal.

You live on an island.

You live on an island where the rest of the world is just water (hypothetically) with 5 gold coins and 5 one dollar bills. On the island, let us say each gold coin is worth $1 each. So 5 gold coins = 5 one dollars.

A lone sailboat swings by.

Now a lone sailboat with a computer printer on board, swings by the island and prints 5 more one dollar bills. The sailboat drops them on the island and then leaves. Now the supply of one dollar bills doubled to 10. So now it is 5 gold coins = 10 one dollars. In other words, it takes 2 dollars to buy 1 gold coin.

Loss of purchasing value.

It is simple supply and demand. All of a sudden the gold coins doubled in price from $1 to $2. A local on the island realized that the $1 in his hand could now only buy a half of one gold coin. Purchasing value was immediately cut in half for that $1.

The smart investor.

If you happened to be an investor before this all happened and had a $1 in your pocket, and knew the sailboat is coming, you would want to buy a gold coin beforehand. Because you knew that afterwards the same gold coin would cost $2. Buying beforehand keeps your purchasing value safe. As a result, you will be better able to take care of your family.

Why is this story relevant today?

Well, money is being printed out of thin air. The dollar supply is increasing which causes inflation. And gold bullion is the ultimate protection from inflation. Sure, gold and silver price today always move up and down but in the long run they outperform, in good times and bad times. The gold value always keeps your wealth safe. Over a hundred years ago one gold coin could buy a nice suit, shirt, tie, and shoes. The same gold coin can do the likewise today. But the same cannot be said for paper money.

What about Federal Reserve Bank changing the money supply?

The Federal Reserve controls the global supply of dollars. When they make more dollars, the price of gold tends to go up in direct proportion to the increase in dollars. It takes more dollars to buy the same quantity of gold. That’s why gold is so famous as a “hedge against inflation”. On the other side of the coin, when the Fed reduces the global supply of dollars, it takes fewer dollars means increased dollar purchasing power, which can buy more gold.

What about Federal Reserve Bank changing the interest rate?

The Fed sets interest rates. If they set high interest rates, it can possibly set a drag on the price of gold because investors might be drawn to investments that pay dividends rather than gold such as Treasury bonds. Conversely, lower rates tend to increase the demand for gold which is the safest form of investment there is.

What does history tell us?

If you happen to look at the past 5,000 years you will see thousands of countries have tried alternatives to the yellow metal. Every time after they debased or diluted their currency to nothing, they had to go back to the yellow metal. It never failed to hold its value. This time will be no different. Use your cash for gold, not the other way around.

*** Go Back To Table of Contents ***So what is the best way to buy gold?

Gold and silver jewelry is good but it is not best way to hold precious metals. Sure, there are jewelry with high karat gold and you may be looking for the best 22ct gold price today. But think about this, once you buy gold jewellery, you cannot quickly and easily sell it for a price equal to what you paid for or higher. No, you need it in a form that is easily recognizable, standard, and highly liquid. Something that can be readily traded on the market where someone will buy it immediately just like money. What form is that? We are talking about BULLION, the highest karat gold you can get, 24k gold. In other words, you should be looking for the 24ct gold price today which we have further below in this article. You can see them in gold price per ounce and gold price per gram. That is the best gold investment you can make. Are you looking for the lowest price of gold in world? Bullion has the cheapest price of gold in world. In other words, solid bars and coins filled with pure gold or silver or platinum. Bullion is pure gold which is 24 karat gold. It is the best karat gold form that you can buy for your gold coin collection because it is recognized and respected world-wide. Buy pure gold this way, as it is the best way to invest in gold.

*** Go Back To Table of Contents ***

Where is the best place to buy gold?

In your search to find the best gold prices and cheapest place to buy gold, please know that it is wise to focus first on reputable dealers. And there are a few where you can buy gold, silver, and platinum coins and bars at great prices. Two of the most reputable dealers we know of are JM Bullion and Golden State Mint.

*** Go Back To Table of Contents ***Introducing you to JM Bullion.

JM Bullion is a leader in online precious metals. The 2019 Internet Retailer rankings placed JM Bullion #96 within the Top 500 online businesses and in the 2019 Primary Merchandise Category (Specialty), JM Bullion was ranked as #5 in the Top 500 list. There is a reason for that. They are one of the best gold shops on the web. The company is solid, honest, and has a great record of providing outstanding services. Every time I have bought from them I have not been disappointed. And each time I was shopping for the best prices on precious metals, JM Bullion has been consistently among the lowest priced bullion dealers to buy from.

*** Go Back To Table of Contents ***But What About The Quality?

The quality is outstanding with JM Bullion. You get a vast array of pure gold, silver, copper, platinum, and palladium products. All of them from the top brands.

*** Go Back To Table of Contents ***But Why Are They Able To Offer A Lower Price Than Competitors?

One reason is is their average inventory carry is in the tens of millions which enable them to sell in-stock items only and satisfy even the largest of clients. Also they focus on the most important products to minimize overhead and unnecessary bloat. As a result, this allows them to charge less over spot than many competitors. As a result you get things like the best spot gold for the money. And not only that, you get free shipping and they ship orders within 1 business day. Now that is a company you can do business with.

*** Go Back To Table of Contents ***What are the best gold coins to buy?

The best gold coins to buy that coin buyers should initially focus on would be the bullion gold coins manufactured by each country's mint and offered to the public. These are the kind of coins that are the most recognized and respected coins in the world. These are the most marketable and liquid coins you can buy and sell. You cannot go wrong with these. The most popular weight would be the one ounce coins but other weights are perfectly acceptable too. We recommend you start with the one ounce gold coins below. This is because they are the most well known, world-wide. You want these in your gold collection, at least to start. You can expand to other types of gold coins after your initial collection is established.

- Gold Coin - American Eagle, 1 ounce

- Gold Coin - Canadian Maple Leaf, 1 ounce

- Gold Coin - South African Kruggerand, 1 ounce

- Gold Coin - Austrian Philharmonic, 1 ounce

- Gold Coin - British Britannia, 1 ounce

- Gold Coin - American Buffalo, 1 ounce

Gold Coin - American Eagle, 1 ounce

Gold Coin - Canadian Maple Leaf, 1 ounce

Gold Coin - South African Kruggerand, 1 ounce

Gold Coin - Austrian Philharmonic, 1 ounce

Gold Coin - British Britannia, 1 ounce

Gold Coin - American Buffalo, 1 ounce

What are the best silver coins to buy?

The same thing can be said for the best quality silver coins, which is bullion silver coins manufactured by each country's mint. We recommend you start with the one ounce silver coins below for the same reason we mentioned on the gold coins. And of course, feel free to expand to other types of silver coins.

*** Go Back To Table of Contents ***Silver Coin - American Eagle, 1 ounce

Silver Coin - Canadian Maple Leaf, 1 ounce

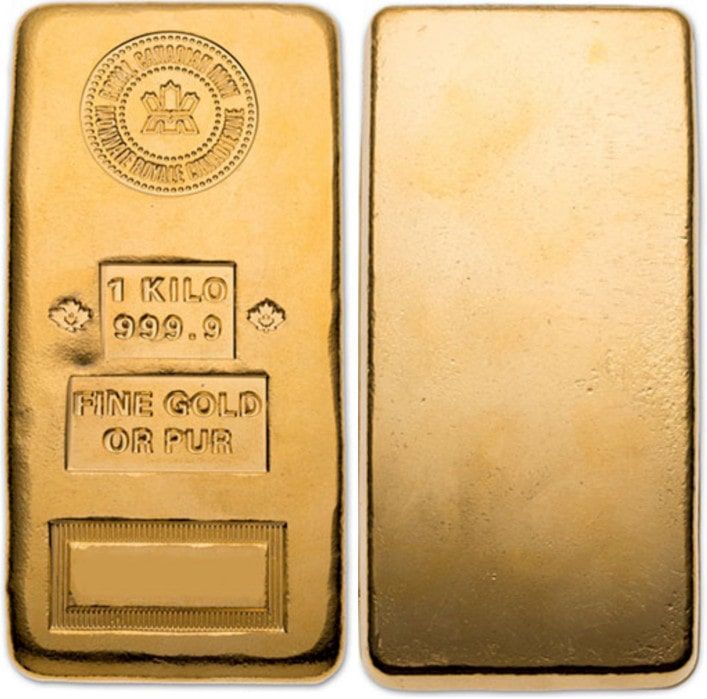

What are the best gold bars to buy?

You want to start with the most respected bars listed below. But feel free to expand to other kinds also later. And they can be of any size. But bigger bars are usually more storage efficient while smaller bars are easier to carry. Also, please remember that bars can come in many shapes and form. That is fine because bullion is pure, and the market respects the purity. You are buying mainly because of the pure content of the precious metal, regardless of how it looks. But of course, you might prefer the best looking ones. That is fine also. But it is the purity that counts at the end.

- Gold Bar - Pamp Suisse

- Gold Bar - Credit Suisse

- Gold Bar - Royal Canadian Mint

- Gold Bar - Valcambi Suisse

Gold Bar - Pamp Suisse

Gold Bar - Credit Suisse

Gold Bar - Royal Canadian Mint

Gold Bar - Valcambi Suisse

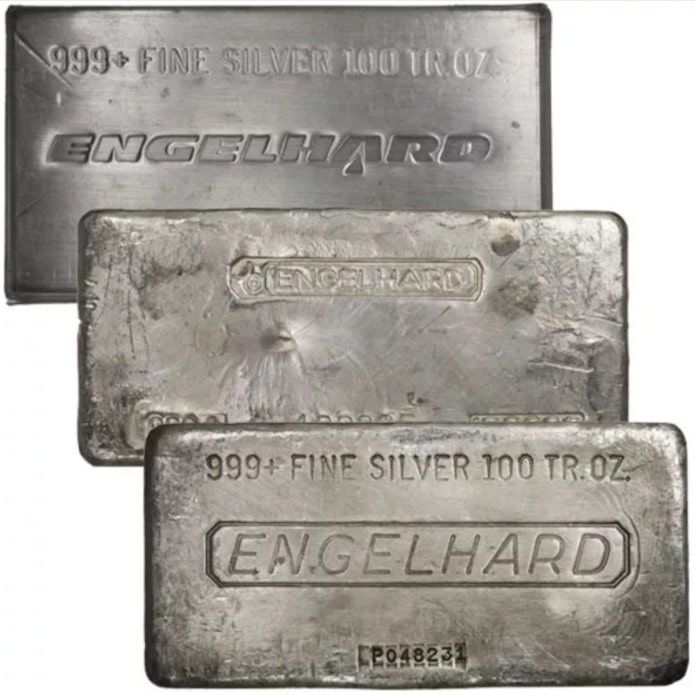

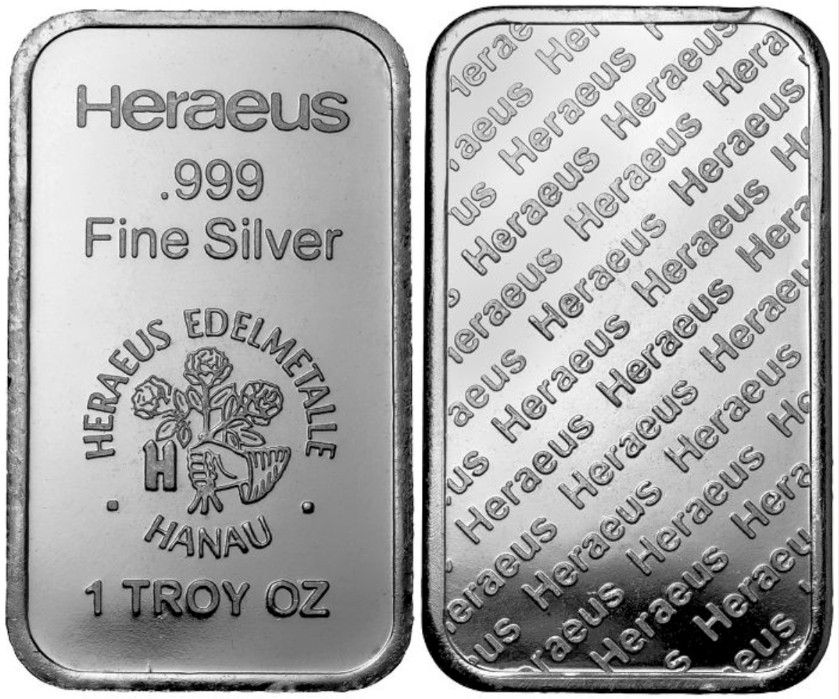

What are the best silver bars to buy?

The same can be said for the silver bars. You want to go with the below to start with and feel free to expand to other kinds also. Please remember that bars can come in many shapes and form.

- Silver Bar - Johnson Matthey

- Silver Bar - Engelhard

- Silver Bar - Royal Canadian Mint

- Silver Bar - Heraeus

Silver Bar - Johnson Matthey

Silver Bar - Engelhard

Silver Bar - Royal Canadian Mint

Silver Bar - Heraeus

As you can see, they have a great set of products. They also cover platinum, palladium, copper, and other precious metals. Please check them out.

Introducing you to Golden State Mint.

Golden State Mint is a private family owned boutique that has been in the precious metals business for a very long time, since 1974. They have become a trustworthy brand and are located in Central Florida. It is common knowledge that reputable and well established family operations give excellent attention to their clients. Naturally, the company’s customer service has gotten very high marks from clients on their products and services. The owners themselves are father and son, Jim and Andrew Pavlakosvery. And they are very involved, friendly, and quick to help. Because of this, they have been known to have the shortest lead times in the industry.

*** Go Back To Table of Contents ***They are not only a Precious Metal Dealer, they are also a Mint.

Their state-of-the-art process and equipment on their production line enable them to use the most modern techniques to produce high quality gold, silver, and copper bullion. You can actually ask them create a custom design of a precious metal coin or bar according to your specifications with the help of Golden State Mint designers. Other dealers act as a middle-man to market this Mint’s products. But you can purchase your coins directly from Golden State Mint and cut out the middle-man, saving you money.

*** Go Back To Table of Contents ***Their Prices Are Very Competitive.

We compared gold and silver bullion prices of Golden State Mint versus other gold dealers. The coin we used in our comparison was the brand new American Silver Eagle, one ounce, as a test. After the review we were pleasantly surprised that the Mint had the best silver prices compared to the 7 leading competitors. The competitor’s premium prices over spot were between 6% to 20% higher than Golden State Mint.

Golden State Mint sells the same kind of gold, silver, coins, and bars as JM Bullion does. The other metals are also included. Please check them out.

***

Go Back To Table of Contents

***

***

Go Back To Table of Contents

***

Conclusion.

Both JM Bullion and Golden State Mint sell gold, silver, platinum, palladium, and copper in bars and coins. Remember these two dealers when you are looking for the best place to buy gold bars and coins. After you establish your collection, you can diversity more into other types of gold and silver and also branch out into other metals, like platinum and palladium. It is all about diversification.

Couple of other things to mention. They both can also can help you with an IRA for your physical metals.

*** Go Back To Table of Contents ***

Also - Like us? Why not click on our Free Newsletter to get timely updates in your inbox.

*** Go Back To Table of Contents ***

Member discussion